Cracking the code of the future of MSPs

By Denes Purnhauser on July 17 2014

There’s been a lot of talk lately about a fundamental change in the MSP industry, and the subject may seem overwhelmingly complex. The change taking place is quite evident, but what’s inside the tornado? What is the force behind this change happening?

Understanding the underlying impetus will enable businesses to make more educated decisions where to drive their companies. Let’s demystify this change and put it in a very easy to digest format, as the core of the change is actually simple.

It is not our shortest Blog but I promise worth the read. You will see the change taking place and how it could help you drive enormous growth in the next couple years. So fasten your seatbelts!

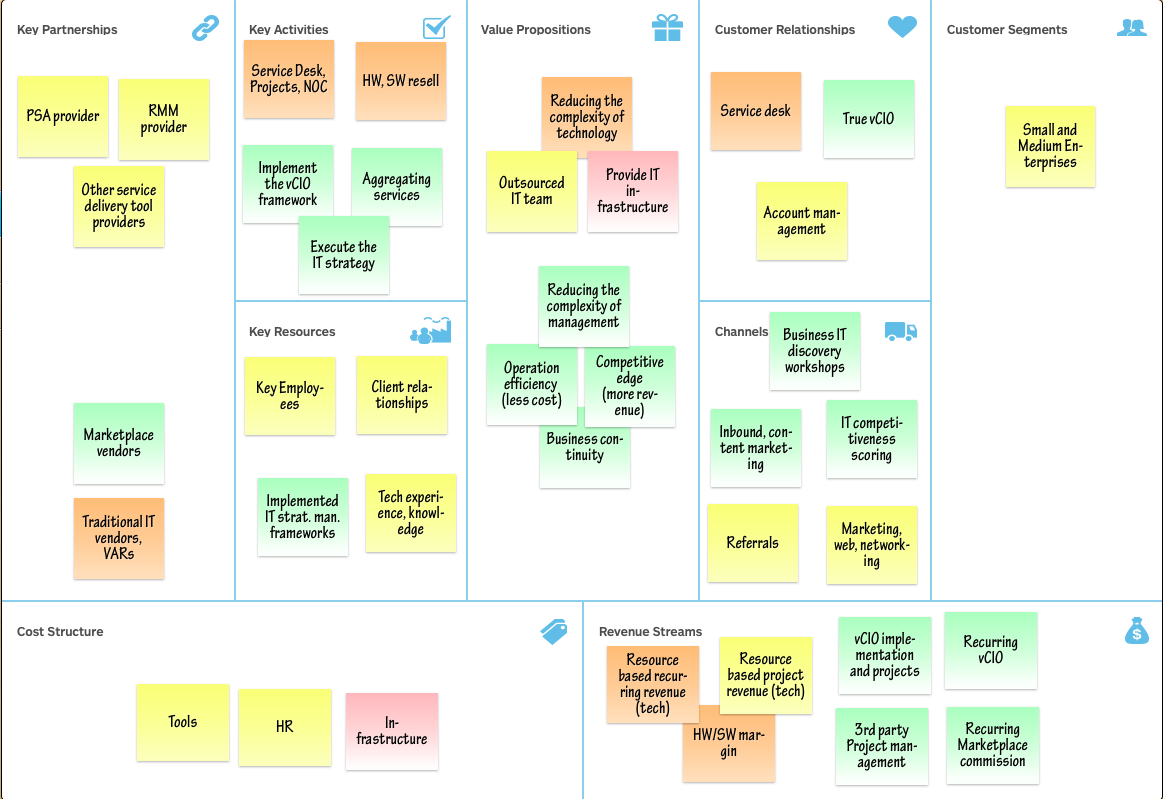

We are going to use one of my favorite thinking tools to analyze and understand the situation: The Business Model Generation framework. We use this method nearly every day, to understand our customers and their business, brainstorm new business ideas, etc. We like it because it is very simple, very straightforward, and separates complex systems into simple components.

We’ll start by showing you the current typical MSP business model and why this model was the right answer for the market needs in the past. Then we’ll look at how the core of market needs have changed and the resulting changes that have been made to the business model.

Market need:

Think way back to when computers first came into the commercial environment and dramatically changed how we do business. These were large and complex systems and unwieldy from a technological perspective. For so many tasks somebody technical was needed to finish the process - to convert a picture, scan a document, set up a network, or just save a file. These tasks needed to be more user friendly and the users to become adept in these environments. The problem to overcome in was technological complexity.

So the IT support companies came to the scene and solved the problem of technological complexity. They have been evolving since, and the most mature format of this service is the Managed Service Provider model.

Let's analyze the classic MSP model, particularly to see how all the aspects of the current model are working together. We will then see how a small change on one part of the business results in adjustments in every field of the model.

Value Proposition:

The core value proposition of an MSP is reducing the complexity of technology. This is the ultimate goal and the value they are delivering to their customers. It can be stated in various ways: "run your business smoothly", "peace of mind”, "security and compliance", or "strategic IT design and decision making". Every company has its own style but all promise to reduce the complexity of the technology in their client's environment.

The core value proposition of an MSP is reducing the complexity of technology. This is the ultimate goal and the value they are delivering to their customers. It can be stated in various ways: "run your business smoothly", "peace of mind”, "security and compliance", or "strategic IT design and decision making". Every company has its own style but all promise to reduce the complexity of the technology in their client's environment.

In order to fulfill this promise, IT managed services providers first create a so-called "Outsourced IT Team" service, which includes all the human resources as an independent unit. Clients do not have the necessary skills or resources to manage these teams.

Second, they provide an "IT infrastructure": design it, build it, manage it, and support it. The infrastructure includes all the switches, servers, desktops, and gadgets and all the software elements on them.

Very simply, this is the core value proposition: reduce the complexity of the technology with outsourced IT staff and IT infrastructure.

Customer Segments:

Regarding size of client company staff the sweet-spot for the traditional small IT companies can range from 20-150. Below this it’s hard to standardize the service and the budget is too low, and beyond it those businesses usually have their own IT department.

Regarding size of client company staff the sweet-spot for the traditional small IT companies can range from 20-150. Below this it’s hard to standardize the service and the budget is too low, and beyond it those businesses usually have their own IT department.

Channels:

The typical sales method for MSPs is word of mouth referrals. As with doctors and lawyers the performance of the provider is judged on criteria unmeasurable by the customer and in industry jargon that no outsider understands. This makes trust and reputation essential factors. An MSP could lose a client by dropping the ball on a deadline, or by neglect, but without these catastrophes it has been a comfortable space to be.

Most IT managed services providers do have some form of website; not so many have a blog or other educational content. However, these are very unlikely to create a "marketing engine", or to excel at collecting and managing leads. Also, most are made by the owners or directors, whose only frameworking tool is a "network assessment tool" which helps them discover the IT infrastructure of the client and give recommendations based on that.

Customer Relationships:

The Service Desk drives the main relationship between the MSP and its clients. While the most important elements in its service quality are the response time, the personalized services, and dedicated resources, many IT companies have outsourced this function and had a hard time afterwards.

In our terminology, account management is still part of the Service Desk, because it’s the management part of the service. Still, some MSPs claim to be vCIOs, though it’s likely that this service was made a part of the MSP package just to improve sales.

Moreover, Virtual CIOs have tended to concentrate on IT infrastructure planning and design, or on doing quarterly "business reviews" and neglecting other parts of the business. They operate without a process-driven separate service offering. The clear loss from this is that very few MSPs will get a call if from a client with a business problem. The client will call once they’ve solved the business problem and they need a new server. Instead of being a business advisory role in most cases it’s one of technology infrastructure advisory.

Key Activities:

While there are several models, there are only three main functions within service delivery: software, hardware, and service areas.

Among existing service areas, there are projects, system developments, NOC, and Service Desk. Some companies separate the project work and maintenance; others some separate NOC from Service Desk.

The HW/SW sales have typically driven the projects, and every 2-3 years major developments were taking place. These developments drove an enormous amount of fixed base revenues for the service providers.

Key Resources:

Key resources are those that if taken away bring the company to a stop. For MSPs, the key resources are the human capital, client contracts, relationships, and experience and knowledge base of service delivery.

Key resources are those that if taken away bring the company to a stop. For MSPs, the key resources are the human capital, client contracts, relationships, and experience and knowledge base of service delivery.

Key Partnerships:

Other more valuable partnerships were based on service delivery software. PSA and RMM solutions directed the quality and the efficiency of service delivery. These companies invested heavily to educate and help IT companies.

Cost Structure:

Revenue Streams:

In terms of revenue streams the most prominent have been the resource-based ongoing revenues, which could be Time and Material, Block of Hours, Retainer, or Recurring service models. Next are the project-based revenues, which usually include fixed costs. On top of these there is a shrinking margin of hardware and software sales.

So, this is the traditional MSP 1.0 model. I have spoken with around 100 MSPs in the last few years. I have read most resources and we have built two MSP-related companies.

Business model design demands the ability to see the patterns and the changes around these whole sets of building blocks. We have to see the precise nature of changes as well as other parts of the business model have to change to adapt.

So let's see what has changed in the last few years related to the classical MSP 1.0 model:

1. Using technology is gets less complex

The user experience of mobile devices has driven an enormous change in reducing the complexity of technology. Just five years ago the method of sharing pictures included taking a photo, downloading it, converting it to Jpeg, and then copying it to a USB drive. Now my parents are doing that all with their mobile devices. Just take the picture, edit if you want and easily share it through Instagram or Facebook.The cloud democratized technology. Everybody can get the latest CRM platform with the swipe of a credit card. There are no implementation plans, consultants, or hefty projects needed. You can just start today and emerge.

Further the current generation of users is now much more comfortable with technology. The complexity of the technology became not just absolutely simple (like using iPhone), but also relatively simple to learn and adopt. Generation X and Y are more willing than ever to search online to solve problems themselves without calling a help desk.

2. Management of technology gets more complex

The market has fragmented. There’s both a multitude of applications around the web solving problems, and numerous corporate and private problems looking for solutions. These realities are often prevented from meeting, however. Both client companies and vendors are specialized in niches, and the sheer numbers make getting together difficult to manage.

The impact of technology on businesses is greater than ever before. Everything is wired and a single point of failure could run a company out of business. Consider CodeSpace: a small company hosting websites, where a hacker was able to erase all their data, including backups. CodeSpace was forced to close their doors. Having a clear vision of all aspects of security, applications, access, vendors, costs etc. is still a management challenge.

The IT budget has also increased because many things that were outside of the IT budget are now included in it. Managing this budget is a complex issue as IT is no longer a technology challenge but a management one.

IT is clearly a strategic asset. It is not the infrastructure but the applications, the adaptability, and the culture are what the company is using,. It can be a differentiating factor among the competition based on costs and customer experience.

So the two major changes that have taken place are, first, the complexity of technology has been declining and second, the management complexity of technology has been increasing. These trends are interdependent and supporting each other.

The problem is that these two factors work against the current MSP model in a big way.

The first is undermining the basic value proposition of an MSP by removing the technological complexity. With demand decreasing, the services that the MSP delivers are devalued. It’s the first thing MSPs are witnessing: fewer client calls and some IT decisions are being made without them.

This is a typical "Red Ocean" scenario, meaning the competition is increasing and the market is commoditizing. This is not a good place to conduct business.

The second trend is creating a new demand, but this demand has not manifested as service requirements yet. There isn’t yet a mainstream service around the problem, so clients aren’t shopping around. While there are still opportunities to solve problems for companies but they aren’t able to translate the myriad choices into a service they want to buy.

Hence this is a typical “Blue Ocean” opportunity. There are few to no competitors. The market is wide open for influence and education and unique value propositions can be made, a new service can be developed, and at a higher value.

However, as you will see, you have to pay a price as well. A switch from the current model is no mean feat and there are many obstacles down the road. This is a higher risk, higher margin model.

If we can properly read all these changes, we then have to design a new business model around them to make a viable business.

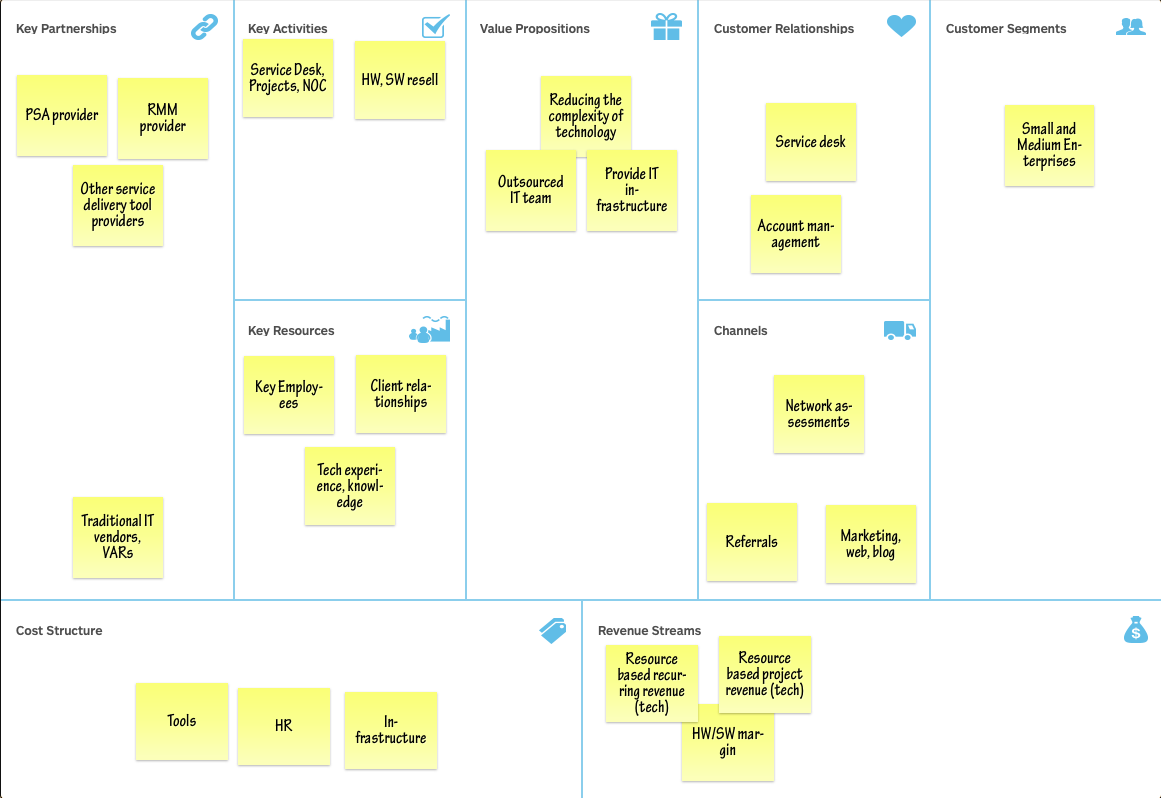

So let's have a look at the so-called MSP 2.0 model. In this chart everything green is new, the orange is of reduced value and everything red is going to be obsolete based on the new model.

The New Value Proposition

Our new value proposition is geared to reducing the complexity of the management of technology. That means our goal is to manage all technology-based business areas - to make the client more competitive through the use of technology. We achieve this in three ways:

Our new value proposition is geared to reducing the complexity of the management of technology. That means our goal is to manage all technology-based business areas - to make the client more competitive through the use of technology. We achieve this in three ways:

- Improved efficiency with technology: find how we can drive down client costs through automation, standardization; better processes, information, communication, and collaboration.

- Competitive edge with technology: fuel client revenue streams with technology, better customer service, faster delivery, and better information flows.

- Maximized business continuity: as the impact of breach is much higher than it used to be, so the IT security, information security, and vulnerability are going to become more important aspects in the business perspective.

“Management" is all about making decisions, creating strategies, planning accordingly, and executing projects. We have to create services around these three building blocks following the principle of the value proposition: We are going to comprehensively handle all the aspects of these management issues on behalf of the client.

This is not entirely new; every MSP has been doing some of this in one area or another. However, this puts it in perspective of the two major shifts. These must be fully fledged service offerings, and not just something we do for our clients as a side offering.

The New Customer Segments:

We have to seek out companies with more complex operation. This kind of service has not been developed for larger groups so we could have 150 to 500-member organizations as targets as well. We may not drive their whole IT strategy, but we could be a part of the Sales, Operation, or HR-related IT strategies. These are also small companies within larger ones with a particular focus. Harvesting those projects could be very profitable.

Also, we have to understand that being thought leaders, and not interested only in infrastructure, could open a lot of doors to larger organizations. This solves the problem of hearing “we already have an IT department” from larger potential customers.

The New Sales Channel:

If we want to sell this new value proposition, we are going to face new challenges. Nobody is buying it now, period. There is no such service around, and the market is still uneducated on these terms.

In order to be able to sell, we have to educate the clients, and we have to "reframe" them. For education, we need to create content and distribute it. A blog is a better start than books and case studies and is a common and effective avenue for content and inbound marketing.

Our value proposition is to increase something that is very intangible. The competitiveness with technology is a pretty fuzzy term. However, the actions and ongoing activities driving competitiveness can be measured. This is "ITCq" (IT Competitiveness quotient); a measuring of all the things related to well-managed technology. Using this tool makes it very easy to start a conversation with prospective clients.

Starting a conversation is one thing but closing deals is another. For that, the different workshops are a great option. We provide services to show our expertise, and then we can move on to important quick-win projects. Those projects are our foot in the door; and after successfully closing those projects, we can open up many other services. This is a seeding rather than a hunting sales approach, with the understanding that clients need time to adopt.

The new client relationships:

It is now apparent that our new core service offering is totally centered around a true virtual CIO role. The True vCIO deals with all aspects of the technology, not just infrastructure.

This role is going to fulfill all the needed high-level management roles, communications, and interactions. It creates all the IT strategies, roadmaps, budgets, and operational plans and manages all the projects needed to execute the strategy. This role is going to drive the perception of our services. The switching cost is considerable - we can still drop the ball on the delivery side if our vCIO isn’t dynamic - but if we stay active and communicate well, we have nothing to fear.

This is a business analyst or IT consultant role. If you don’t yet have one, hire someone with this skill. Set processes and job descriptions in place so you can train and set expectations for his or her performance.

The New Key Activities:

Because the vCIO services are now standing on their own, not attached to an MSP contract, we need to incorporate an "IT management framework" that comprises all the processes and deliverables that IT management now does and the vCIO is working on. The IT management framework is like a small ITIL, or any other framework, but more practical and automated.

We are using our own 7C IT management framework for that reason. The ITCq is the tool which measures all of the activities we have in the 7C framework. Implementing that sort of framework produces a decent revenue and creates a very visible form of ongoing services to maintain and further develop the client’s IT competitiveness. It contains yearly strategy, planning, budgeting, and auditing, based on templates and best practices. Everything goes into the software that clients can access, and which we can use to make what we bring more tangible and visible to the clients.

Because we are creating IT strategies, someone has to manage them. This includes overseeing all the IT projects the client is doing, but it could also be the specific third-party project management of a larger solution.

We will continue operating our NOC, Helpdesk, and traditional IT infrastructure services as long as it makes sense.

New Key Resources:

The key resources of the traditional model have not changed and only one is added. The IT management frameworks are now a huge value. The clients have locked in and we are driving the heart of their business. Looking at your company valuation, this will be the highest component in two to five years.

The key resources of the traditional model have not changed and only one is added. The IT management frameworks are now a huge value. The clients have locked in and we are driving the heart of their business. Looking at your company valuation, this will be the highest component in two to five years.

New Key Partnerships:

The goal is to get some commission based on the sales of those services. As a vCIO, you are making decisions on behalf of the client, which means you are going to face problems and look for solutions. Your marketplace is the set of solutions looking for problems. You are the interface between the two worlds, coupling problems with services.

If you think five years into the future, 75% of an average client's budget will come from cloud-based solutions. It’s not difficult to calculate how much money an MSP could make based only on recurring commissions. A general cloud-based provider (Salesforce, Google, or Microsoft) could offer 8-10% of the sales recurring. A smaller niche provider could leave 20-30% of the sales on your side. Revenue could be coming in every month with just these partnerships.

This is a cloud broker model. However, we are not brokering just traditional cloud service providers, but every software company, because everybody will be switching to a cloud-based delivery model in the near future.

New Cost Structure:

Nothing has changed. We are probably paying more to create marketing content, education, and to train ourselves and our staff.

Nothing has changed. We are probably paying more to create marketing content, education, and to train ourselves and our staff.

New Revenue Streams:

Plenty of new possibilities here. Revenue streams: the vCIO and IT management framework implementation projects have significant power. These projects create all the prerequisites for IT management including procedures, processes, strategies, plans, contracts, and agreements with vendors that have to be created to manage the environment.

Revenue streams: the vCIO and IT management framework implementation projects have significant power. These projects create all the prerequisites for IT management including procedures, processes, strategies, plans, contracts, and agreements with vendors that have to be created to manage the environment.

The sales process has to be adopted in the early stage of the market. Delivery must incorporate a new role. Processes and procedures must drive the new role, instead of doing it ad-hoc, to gain recurring predictable and scalable service revenues.

A new way of connecting problems to solutions comes from the nature of the vCIO role. Creating such a marketplace is a natural move to make the business more predictable and scalable .

Conclusion:

These are two big trends of technology - it’s becoming easier to use while management of all the choices is more complex and creating a tornado. If you think you are going to be able to stay only a 1.0 MSP, cloud and reduced complexity is going to put you out of business. If you are not getting into IT management, you are missing the boat.

The new model will enter into the mainstream in the next few years. As it does the incumbents will have tremendous advantage over new entrants. The learning curves, the thought leadership, and the processes are hard to copy or implement quickly. In my opinion, someone who invests now and spends the next few years developing this model would be reaping the profits in the following 5 to 10 years.

During the next session, we are going to talk about the specific MSP 2.0 related Projects, Ongoing Services, and the natural adoption of the model in 12-24 months, so stay tuned. Subscribe to the Blog alert on the top right to make sure you get the new articles.

The process of becoming the Trusted Advisor

By Denes Purnhauser on July 8 2014

For Managed Services Providers (MSPs) the ultimate goal is becoming the ‘trusted advisor’ on all things IT.

We’ve created a process which enables MSPs to earn this trusted advisory role as fast as possible. The key is to understand the client, and in turn help them understand their situation and their opportunities.

Looking into the 7C Methodology and processes can be a tad overwhelming at first, we know. It’s so effective because it’s comprehensive, so there is a learning curve. However in our continuous effort to make everything as simple as possible, we’ll start by emphasising a couple of core concepts.

One of the crucial elements is the client reframing process. From the client’s perspective it’s a discovery process, the goal of which is to make the necessary transformation to start working with the client at a new level. The key component of the process is the Reframing 7C canvas workshop, where we ask questions of the client’s business in order to help the client rethink basic assumptions about IT and its management. Normally such a fundamental shift is a tough, very high level process, but if you’re properly prepared to ask the right questions and challenge the client, it can be a very easy and straightforward process.

Client Discovery

So to be able to conduct the workshop - the central element - with confidence, we have to be as informed as possible regarding the client, as well as the nature of the company itself: the key players, industry etc. We need a streamlined data acquisition process to be able to immediately focus on what matters. With an established client this is much easier...it’s the new for whom you must prepare a bit more.

If you peruse the 7C Report, you’ll find it entails all this needed information about your client in IT function and their IT management perspective.

To be able to get the necessary data from the client and to be able to make the analysis and build the report, you need input. This input comes from the questionnaire you get your prospective client to fill out - not the client's ‘IT guy’, or service provider, but the CEO of the company -the one responsible for the IT in general at the senior level. We’ve provided several helpful methods encourage them to fill out this questionnaire. If it seems like a big deal for them you can infer either that they do not trust the value of the process, or that they see little value in IT generally. In either case you can make the transition with the workshop, so do your best to get started with the questionnaire.

This is the discovery of the client that prepares for the workshop.

Reframing Workshop

In the workshop you are going to use the 7C Canvas as a companion. It goes on your wall and comprises all the building blocks of the competitiveness of IT.

This is meaningfully accessible to the client: there is the IT execution segment, and the IT management - both cost-effectiveness and the competitive edge. It creates a conducive platform for talk about the company's challenges, issues and the possible IT related solutions.

First of all the Canvas will assist your confidence in the meeting, with the information on the wall 100% aligned with the report, scores, etc.

Secondly, it outlines the structure of the session, which in turn helps you to facilitate it.

Thirdly, it engages the clients in conversation - this is a workshop, and your goal is to work together and strengthen the relationship.

Fourthly, unlike some workshops, the Canvas remains, a good basis for further conversation between the CEO and the rest of the company.

The outcome of the meeting is some initial action items involving overall objectives, directions, and possible initiatives or projects.

Action Plan

Your next duty is to build a comprehensive action plan for them based on the results, and set a possible achievable target score, and to put everything in context, set priorities, state realistic expectations about IT project sizes, IT budgets, possible results, and the necessary capacity from the senior level or from staff.

So now you are becoming a natural leader of their Global IT, not just the infrastructure, background, support etc, and you can come up with big projects and industry changing initiatives with IT. This is the process of how to start your work, what you need to achieve the first quarterly plan.

As you start the first company-wide quarterly plan (the cornerstone and "trial" of the MSP 2.0 model), you are incurring more information, more trust, and even more loyalty.

Here’s where we kickstart the MSP 2.0 onboarding process to implement all necessary parts of the model - where you are able to start the complete IT management operation with the client.

Conclusion

Maybe you see this is a long process, but slow is fast and fast is slow in this arena...the initial investment of preparation will soon lead to a pivotal element, the inflection point which is the workshop. You get the client’s attention and from there are able to reframe them. Discovery and the preparation, workshop, action plan, and finally trial quarterly management - these five components give you the proven process of client reframing.

MSP East vs West All Star Game

By Dr Peter Torbagyi on June 25 2014

We have been producing a fair amount of research on the topic of MSPs offering vCIO services.

Because one of my colleagues is a great NBA fan, we’re now able to present the “MSP East vs. West all star” comparison.

Now we’re very sceptical guys, but since this is based on work with 591 IT managed services providers, we inclined to believe that this is a reasonable view of the real situation of the US Virtual CIO market.

But we like to be sure, and you could help us!

Go to our virtual poll and vote for your team if your MSP offers vCIO services! Choose the NBA team based on your company operation. If you have multiple locations, you can vote with each of them.

We close the vote on the Independence Day, and then we can have a heated conversation why East has beaten West so much. Or the other way around? :-)

Final Report of Survey Results

- New York Knicks 14.29%

- Golden State Warriors 14.29%

- Chicago Bulls 9.52%

- Dallas Mavericks 9.52%

- Los Angeles Lakers 9.52%

- Cleveland Cavaliers 4.76%

- Boston Celtics 4.76%

- Atlanta Hawks 4.76%

- San Antonio Spurs 4.76%

- Houston Rockets 4.76%

- Washington Wizards 4.76%

- Philadelphia 76ers 4.76%

- Oklahoma City Thunder 4.76%

- Sacramento Kings 4.76%

- Defining vCIOs from around the world: Part 1 - Canada

- Defining vCIOs from around the world: Part 2- New Zealand

- Defining vCIOs from around the world: Part 3- Australia

- Defining vCIOs from around the world: Part 4- United States

- Managed Services Platform vCIO Report 2019

- Managed Services Platform vCIO Report 2020

The Hard Truth: network assessments can end up as an MSP's worst enemy

By Denes Purnhauser on May 15 2014

Most IT managed services providers are heavily dependent on some form of network assessment practice during their MSP sales process. They gather information on all the prospect’s devices, identify problems and performance-related issues, and then present a comprehensive report, with an action plan that aims to fix those problems.

Although this practice can surely help win over new clients, it also can be the single most important obstacle they face down the road, in terms of further work with them.

The mistake is that the network assessment puts the MSP into the "techy slot". This is a matter of the client's perspective; executives put potential vendors into this slot to make their busy livese easier and simplify their world. There are slots in the executives' minds for many things: roles as consultant, service provider, software company or industry, HR, IT, or accounting.

There are also varying levels of importance to them: high (business-related), medium (operations), low (support), and of accessibility, such as the scarce/premium, easy to access, and commodities. So for IT providers to excel now in the industry, they should seek a business-related consultant slot where there are high levels of scarcity, rather than staying in the IT slot, as a service provider, low-level support or commodity slot.

The untold story is that these first impressions are very difficult to change later on. Once the deal is made with us pegged in the tech slot, it becomes a self-fulfilling prophecy; instead of being judged on our experience and skills, we are sold short by common perception. If they see that our company is professional only on low-tech ground work, then they’ll subscribe to only low-level tech services, and we’ll of course perform those eminently well, securing their perception. A negative outcome of a positive feedback loop - closed. Done. Locked for eternity.

That’s why a different first impression is crucial. (There’s no second chance at a first impression.) If providers cannot manage this first impression, they could be dropped into a slot from which there is no way out. It is the slot we could call "the deadly tech slot." This isn’t what the network assessment is supposed to do - relegating us to the lowest possible category in the mind of our potential clients and a role as a low-tech solution provider.

Ok, I admit I’ve never actually heard any IT service provider complaining that they’re in the tech slot. They proudly purport that they’re in the business / trusted advisor slot. However we all know the difference between how one is seen and how one thinks one is seen. The fact is that there is a high chance that the client's perception is completely different than your company thinks.

Obviously, no one wants to be in the "tech slot" nowadays. It limits potential growth opportunities, control of the client, influence on decisions, profitability, and so on. Everybody wants to be a high-level outsourced IT executive and IT department for their clients. So then why and how it is happening anyway during the network assessment process?

1. Having the wrong conversation

First of all, the network assessment is driving the wrong conversation. It centers around technology-based, device-based, and tech-based ideas...about the flaws and risks and reactionary firefighting solutions.

This is a hot topic for the provider, but C-level decision makers usually don’t much care. They want a conversation about how to go from good to great, but instead are dragged into one about how to go from lame to mediocre.

The cause? The network assessment leads only to the service provider's concerns instead of the client's. There is no business-relevant context; only the "IT benchmarks" of mostly irrelevant artificial metrics that skirt around what the focus should be.

2. Causing the Wrong Client Feeling

Detailing to the clients how badly they’re performing puts them in a defensive position and thus puts the solution provider into an offensive light. The report can show that the clients have little control over their poor decisions, unwise expenditures, and weak ideas in the field, so they can easily feel backed into a corner.

They may even think it irrelevant - they already know they could be doing better, why do they need to sit through this - so they may not carry the conversation any further. Or when they do go through with the "investment" it’s because they’re frightened out of their comfort zones regarding potential risks, etc.

Thus, the decision is not motivated by will and vision, but by pressure, which easily fades away after the tension eases. These emotions are not ideal on which to build a relationship. Moreover, such feelings can misguide the provider about a sudden quick win-- they can sense huge opportunities that actually do not exist.

3. Creating the Wrong Environment:

The wrong environment does not help to carry business conversations and enable positive insights about the company. It does not focus on hope, enthusiasm, optimism, or growth—the typical entrepreneurial values. The environment our clients should be given is one where they can brainstorm... about the company, future projects, improvements, etc.

If we’re not encouraging a creative, "think big" environment, there will be no major projects, improvements, or developments. Only cost will matter; they will invest as little as possible because they don’t see the real value in what we can offer. They focus on problems, (most of them artificial) and how to fix them, rather than on how to invest in the future and create a compelling vision together.

How to fix this process - to change the game by creating the business context first.

Put the network assessment aside for a while, until we have created our image as business partners. It will remain a crucial element of the process, but not define the process itself. We must create the business context around the IT, and then the IT context around all the IT-related activities that the network assessment can measure.

1. Building the business context:

We need to act as IT consultants, using techniques consultants use to acquire clients. We have to be curious about the non-IT-related fields, such as how they grow, their customer challenges, and how their industry is changing. Not in a small-talk way, but with comprehensive, tough, thought-provoking conversations.

This will push us out of our comfort zone a bit, but relax! As a fellow business owner, you have more in common than you might think. Asking questions, actively listening, and not giving any advice up front are all key.

Peel the onion; dig deeper into the why. In this way we’ll create trust and understanding. Believe me, very few companies are doing that, so the client will be delighted to talk with you. You’re going to be a very rare breed; a scarce resource to find.

2. Building the IT execution context:

Once we understand their business context, only then can we drive the conversation toward the technology field: the leadership of IT, the people inside, the users, the company culture...by actually seeing their devices, watching how they use them, discovering their personal goals, etc.

Here, the critical element is to find out why they may have IT challenges, how they are operating, who is responsible for the field, and what other duties or priorities they may have. What is the level of their operation maturity? We have to understand the management issues or problems that can cause mediocre IT performance. We have to assure them that we have a complete view of what they’re facing.

We see the root of the poor decisions they might have made, as well as the problems they face right now, so we’re starting from the very top, from the very core of the business, and most importantly, we’re considering the individual motivations. After clarifying their IT context, we can then do the network assessment to get a clear picture about the specific problems and situation.

The result of the process:

After gathering all the business context discovery experience, and having all the IT execution discovery experience, we’re going to see the results of the network assessment completely differently, and we won’t concentrate on problems and challenges or create fear and bad feelings in the clients.

Instead, we’re going to focus on the big picture and the potential opportunities to make their company more productive: the benefits of our initiatives and a positive picture which will be much more likely to engage them. We can and must use our existing discovery tools, but only after we’ve created the context of our presence. This is what we call the reframing sales process, where we can change the game.

Research: World of Virtual CIOs on LinkedIn

By Dr Peter Torbagyi on May 12 2014

I was interested about the vCIO, vCTO, and Virtual Executive types of services. So my colleague Peter did some research on LinkedIn on the topic. Keep in mind everything herein is based on LinkedIn publicly accessible data...it’s interesting but there’s a limit to the depth of research you can do this way.So in general, I found that clearly the Virtual CIO industry is driven by the US. I can confirm this from personal experience, that American MSPs are much more comfortable with this term than European or even Canadian IT managed services providers.

- since 70% of vCIOs are hired by companies with under 200 employees, and 9% to large organizations (10,000+), there must be some local support need for interim or part-time high level IT executives.

- when looking at companies offering vCIO services, 97% have fewer than 50 employees and just over half (55%) have a staff roster of under 10.

Here’s our slide deck on our findings:

- 78% of vCIOs have more than 10 years experience, 16% between 6 and 10 - not surprising figures.

- the most essential roles of vCIOs are IT Consultant, Engineer, Sales, and Business Development. Interestingly 12% of identify as entrepreneur, in the sense that they are owners of an MSP organization.

- from what we see these vCIOs doing on LinkedIn, it seems that the largest collectors of these people is the cloud-related, and traditional CIO groups.

- 84% of these people exhibit little to no activity on the LinkedIn social network.

What I get out of this in summary is that there is no accepted academic definition of a vCIO, though companies do grasp the idea of a part time C-level executive assigned to the wheelhouse of their IT. The need is evident...just not widely recognized.

From this I see that we need to address the following: how to define and communicate the value proposition, the MSP sales funnel and the specific service offering that IT companies have invented to sell and deliver vCIO services.

The next step would be to define the vCIO roles and responsibilities and create a framework around their work. This would be required to disseminate this unrecognized need, and to enable the less resourced or less innovative IT managed services providers to start such services, and help the current vCIO practitioners to streamline their vCIO type of services.

See: 2019 Managed Services Platform vCIO Report and Managed Services Platform Account Manager Report 2019