Cracking the code of the future of MSPs

By Denes Purnhauser on July 17 2014

There’s been a lot of talk lately about a fundamental change in the MSP industry, and the subject may seem overwhelmingly complex. The change taking place is quite evident, but what’s inside the tornado? What is the force behind this change happening?

Understanding the underlying impetus will enable businesses to make more educated decisions where to drive their companies. Let’s demystify this change and put it in a very easy to digest format, as the core of the change is actually simple.

It is not our shortest Blog but I promise worth the read. You will see the change taking place and how it could help you drive enormous growth in the next couple years. So fasten your seatbelts!

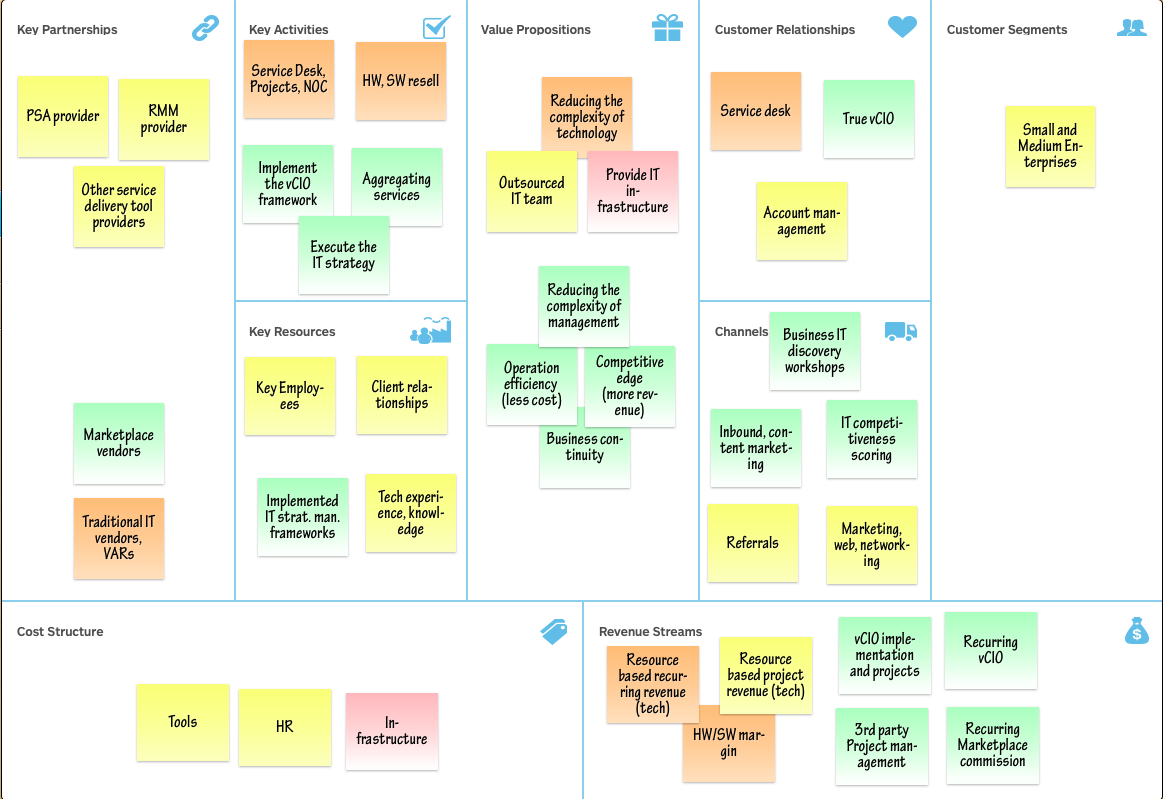

We are going to use one of my favorite thinking tools to analyze and understand the situation: The Business Model Generation framework. We use this method nearly every day, to understand our customers and their business, brainstorm new business ideas, etc. We like it because it is very simple, very straightforward, and separates complex systems into simple components.

We’ll start by showing you the current typical MSP business model and why this model was the right answer for the market needs in the past. Then we’ll look at how the core of market needs have changed and the resulting changes that have been made to the business model.

Market need:

Think way back to when computers first came into the commercial environment and dramatically changed how we do business. These were large and complex systems and unwieldy from a technological perspective. For so many tasks somebody technical was needed to finish the process - to convert a picture, scan a document, set up a network, or just save a file. These tasks needed to be more user friendly and the users to become adept in these environments. The problem to overcome in was technological complexity.

So the IT support companies came to the scene and solved the problem of technological complexity. They have been evolving since, and the most mature format of this service is the Managed Service Provider model.

Let's analyze the classic MSP model, particularly to see how all the aspects of the current model are working together. We will then see how a small change on one part of the business results in adjustments in every field of the model.

Value Proposition:

The core value proposition of an MSP is reducing the complexity of technology. This is the ultimate goal and the value they are delivering to their customers. It can be stated in various ways: "run your business smoothly", "peace of mind”, "security and compliance", or "strategic IT design and decision making". Every company has its own style but all promise to reduce the complexity of the technology in their client's environment.

The core value proposition of an MSP is reducing the complexity of technology. This is the ultimate goal and the value they are delivering to their customers. It can be stated in various ways: "run your business smoothly", "peace of mind”, "security and compliance", or "strategic IT design and decision making". Every company has its own style but all promise to reduce the complexity of the technology in their client's environment.

In order to fulfill this promise, IT managed services providers first create a so-called "Outsourced IT Team" service, which includes all the human resources as an independent unit. Clients do not have the necessary skills or resources to manage these teams.

Second, they provide an "IT infrastructure": design it, build it, manage it, and support it. The infrastructure includes all the switches, servers, desktops, and gadgets and all the software elements on them.

Very simply, this is the core value proposition: reduce the complexity of the technology with outsourced IT staff and IT infrastructure.

Customer Segments:

Regarding size of client company staff the sweet-spot for the traditional small IT companies can range from 20-150. Below this it’s hard to standardize the service and the budget is too low, and beyond it those businesses usually have their own IT department.

Regarding size of client company staff the sweet-spot for the traditional small IT companies can range from 20-150. Below this it’s hard to standardize the service and the budget is too low, and beyond it those businesses usually have their own IT department.

Channels:

The typical sales method for MSPs is word of mouth referrals. As with doctors and lawyers the performance of the provider is judged on criteria unmeasurable by the customer and in industry jargon that no outsider understands. This makes trust and reputation essential factors. An MSP could lose a client by dropping the ball on a deadline, or by neglect, but without these catastrophes it has been a comfortable space to be.

Most IT managed services providers do have some form of website; not so many have a blog or other educational content. However, these are very unlikely to create a "marketing engine", or to excel at collecting and managing leads. Also, most are made by the owners or directors, whose only frameworking tool is a "network assessment tool" which helps them discover the IT infrastructure of the client and give recommendations based on that.

Customer Relationships:

The Service Desk drives the main relationship between the MSP and its clients. While the most important elements in its service quality are the response time, the personalized services, and dedicated resources, many IT companies have outsourced this function and had a hard time afterwards.

In our terminology, account management is still part of the Service Desk, because it’s the management part of the service. Still, some MSPs claim to be vCIOs, though it’s likely that this service was made a part of the MSP package just to improve sales.

Moreover, Virtual CIOs have tended to concentrate on IT infrastructure planning and design, or on doing quarterly "business reviews" and neglecting other parts of the business. They operate without a process-driven separate service offering. The clear loss from this is that very few MSPs will get a call if from a client with a business problem. The client will call once they’ve solved the business problem and they need a new server. Instead of being a business advisory role in most cases it’s one of technology infrastructure advisory.

Key Activities:

While there are several models, there are only three main functions within service delivery: software, hardware, and service areas.

Among existing service areas, there are projects, system developments, NOC, and Service Desk. Some companies separate the project work and maintenance; others some separate NOC from Service Desk.

The HW/SW sales have typically driven the projects, and every 2-3 years major developments were taking place. These developments drove an enormous amount of fixed base revenues for the service providers.

Key Resources:

Key resources are those that if taken away bring the company to a stop. For MSPs, the key resources are the human capital, client contracts, relationships, and experience and knowledge base of service delivery.

Key resources are those that if taken away bring the company to a stop. For MSPs, the key resources are the human capital, client contracts, relationships, and experience and knowledge base of service delivery.

Key Partnerships:

Other more valuable partnerships were based on service delivery software. PSA and RMM solutions directed the quality and the efficiency of service delivery. These companies invested heavily to educate and help IT companies.

Cost Structure:

Revenue Streams:

In terms of revenue streams the most prominent have been the resource-based ongoing revenues, which could be Time and Material, Block of Hours, Retainer, or Recurring service models. Next are the project-based revenues, which usually include fixed costs. On top of these there is a shrinking margin of hardware and software sales.

So, this is the traditional MSP 1.0 model. I have spoken with around 100 MSPs in the last few years. I have read most resources and we have built two MSP-related companies.

Business model design demands the ability to see the patterns and the changes around these whole sets of building blocks. We have to see the precise nature of changes as well as other parts of the business model have to change to adapt.

So let's see what has changed in the last few years related to the classical MSP 1.0 model:

1. Using technology is gets less complex

The user experience of mobile devices has driven an enormous change in reducing the complexity of technology. Just five years ago the method of sharing pictures included taking a photo, downloading it, converting it to Jpeg, and then copying it to a USB drive. Now my parents are doing that all with their mobile devices. Just take the picture, edit if you want and easily share it through Instagram or Facebook.The cloud democratized technology. Everybody can get the latest CRM platform with the swipe of a credit card. There are no implementation plans, consultants, or hefty projects needed. You can just start today and emerge.

Further the current generation of users is now much more comfortable with technology. The complexity of the technology became not just absolutely simple (like using iPhone), but also relatively simple to learn and adopt. Generation X and Y are more willing than ever to search online to solve problems themselves without calling a help desk.

2. Management of technology gets more complex

The market has fragmented. There’s both a multitude of applications around the web solving problems, and numerous corporate and private problems looking for solutions. These realities are often prevented from meeting, however. Both client companies and vendors are specialized in niches, and the sheer numbers make getting together difficult to manage.

The impact of technology on businesses is greater than ever before. Everything is wired and a single point of failure could run a company out of business. Consider CodeSpace: a small company hosting websites, where a hacker was able to erase all their data, including backups. CodeSpace was forced to close their doors. Having a clear vision of all aspects of security, applications, access, vendors, costs etc. is still a management challenge.

The IT budget has also increased because many things that were outside of the IT budget are now included in it. Managing this budget is a complex issue as IT is no longer a technology challenge but a management one.

IT is clearly a strategic asset. It is not the infrastructure but the applications, the adaptability, and the culture are what the company is using,. It can be a differentiating factor among the competition based on costs and customer experience.

So the two major changes that have taken place are, first, the complexity of technology has been declining and second, the management complexity of technology has been increasing. These trends are interdependent and supporting each other.

The problem is that these two factors work against the current MSP model in a big way.

The first is undermining the basic value proposition of an MSP by removing the technological complexity. With demand decreasing, the services that the MSP delivers are devalued. It’s the first thing MSPs are witnessing: fewer client calls and some IT decisions are being made without them.

This is a typical "Red Ocean" scenario, meaning the competition is increasing and the market is commoditizing. This is not a good place to conduct business.

The second trend is creating a new demand, but this demand has not manifested as service requirements yet. There isn’t yet a mainstream service around the problem, so clients aren’t shopping around. While there are still opportunities to solve problems for companies but they aren’t able to translate the myriad choices into a service they want to buy.

Hence this is a typical “Blue Ocean” opportunity. There are few to no competitors. The market is wide open for influence and education and unique value propositions can be made, a new service can be developed, and at a higher value.

However, as you will see, you have to pay a price as well. A switch from the current model is no mean feat and there are many obstacles down the road. This is a higher risk, higher margin model.

If we can properly read all these changes, we then have to design a new business model around them to make a viable business.

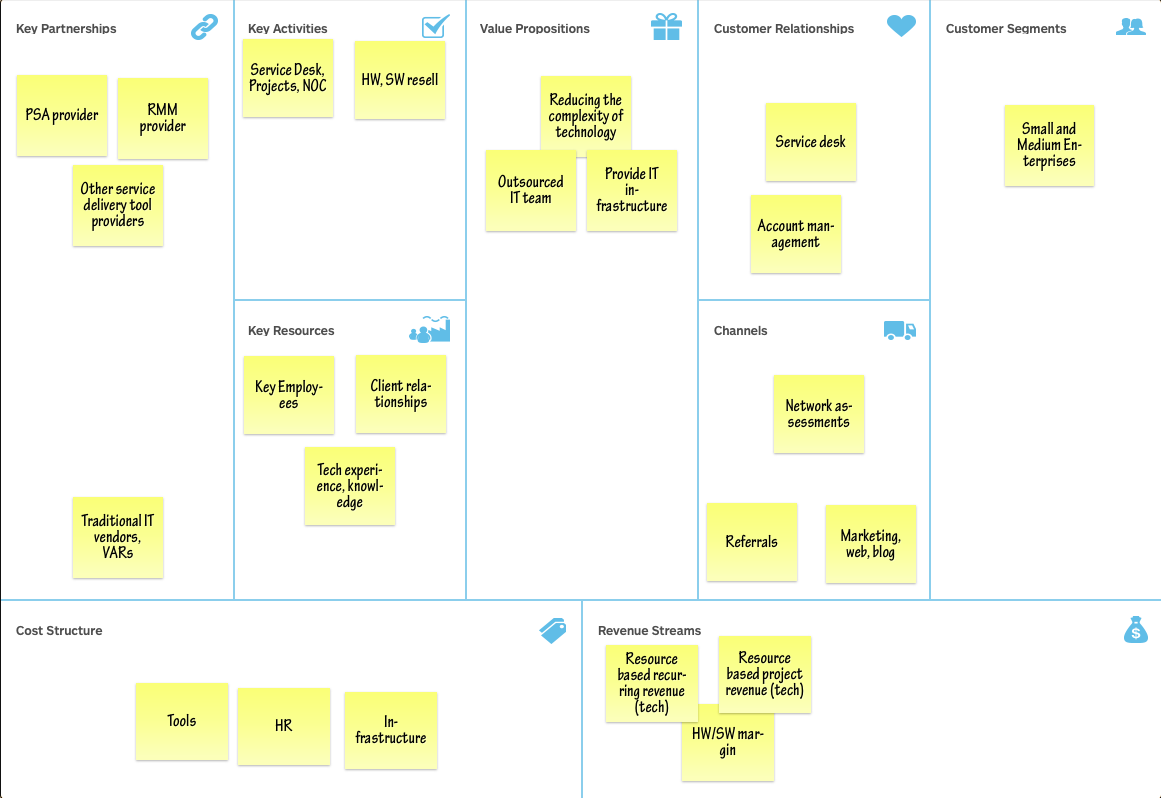

So let's have a look at the so-called MSP 2.0 model. In this chart everything green is new, the orange is of reduced value and everything red is going to be obsolete based on the new model.

The New Value Proposition

Our new value proposition is geared to reducing the complexity of the management of technology. That means our goal is to manage all technology-based business areas - to make the client more competitive through the use of technology. We achieve this in three ways:

Our new value proposition is geared to reducing the complexity of the management of technology. That means our goal is to manage all technology-based business areas - to make the client more competitive through the use of technology. We achieve this in three ways:

- Improved efficiency with technology: find how we can drive down client costs through automation, standardization; better processes, information, communication, and collaboration.

- Competitive edge with technology: fuel client revenue streams with technology, better customer service, faster delivery, and better information flows.

- Maximized business continuity: as the impact of breach is much higher than it used to be, so the IT security, information security, and vulnerability are going to become more important aspects in the business perspective.

“Management" is all about making decisions, creating strategies, planning accordingly, and executing projects. We have to create services around these three building blocks following the principle of the value proposition: We are going to comprehensively handle all the aspects of these management issues on behalf of the client.

This is not entirely new; every MSP has been doing some of this in one area or another. However, this puts it in perspective of the two major shifts. These must be fully fledged service offerings, and not just something we do for our clients as a side offering.

The New Customer Segments:

We have to seek out companies with more complex operation. This kind of service has not been developed for larger groups so we could have 150 to 500-member organizations as targets as well. We may not drive their whole IT strategy, but we could be a part of the Sales, Operation, or HR-related IT strategies. These are also small companies within larger ones with a particular focus. Harvesting those projects could be very profitable.

Also, we have to understand that being thought leaders, and not interested only in infrastructure, could open a lot of doors to larger organizations. This solves the problem of hearing “we already have an IT department” from larger potential customers.

The New Sales Channel:

If we want to sell this new value proposition, we are going to face new challenges. Nobody is buying it now, period. There is no such service around, and the market is still uneducated on these terms.

In order to be able to sell, we have to educate the clients, and we have to "reframe" them. For education, we need to create content and distribute it. A blog is a better start than books and case studies and is a common and effective avenue for content and inbound marketing.

Our value proposition is to increase something that is very intangible. The competitiveness with technology is a pretty fuzzy term. However, the actions and ongoing activities driving competitiveness can be measured. This is "ITCq" (IT Competitiveness quotient); a measuring of all the things related to well-managed technology. Using this tool makes it very easy to start a conversation with prospective clients.

Starting a conversation is one thing but closing deals is another. For that, the different workshops are a great option. We provide services to show our expertise, and then we can move on to important quick-win projects. Those projects are our foot in the door; and after successfully closing those projects, we can open up many other services. This is a seeding rather than a hunting sales approach, with the understanding that clients need time to adopt.

The new client relationships:

It is now apparent that our new core service offering is totally centered around a true virtual CIO role. The True vCIO deals with all aspects of the technology, not just infrastructure.

This role is going to fulfill all the needed high-level management roles, communications, and interactions. It creates all the IT strategies, roadmaps, budgets, and operational plans and manages all the projects needed to execute the strategy. This role is going to drive the perception of our services. The switching cost is considerable - we can still drop the ball on the delivery side if our vCIO isn’t dynamic - but if we stay active and communicate well, we have nothing to fear.

This is a business analyst or IT consultant role. If you don’t yet have one, hire someone with this skill. Set processes and job descriptions in place so you can train and set expectations for his or her performance.

The New Key Activities:

Because the vCIO services are now standing on their own, not attached to an MSP contract, we need to incorporate an "IT management framework" that comprises all the processes and deliverables that IT management now does and the vCIO is working on. The IT management framework is like a small ITIL, or any other framework, but more practical and automated.

We are using our own 7C IT management framework for that reason. The ITCq is the tool which measures all of the activities we have in the 7C framework. Implementing that sort of framework produces a decent revenue and creates a very visible form of ongoing services to maintain and further develop the client’s IT competitiveness. It contains yearly strategy, planning, budgeting, and auditing, based on templates and best practices. Everything goes into the software that clients can access, and which we can use to make what we bring more tangible and visible to the clients.

Because we are creating IT strategies, someone has to manage them. This includes overseeing all the IT projects the client is doing, but it could also be the specific third-party project management of a larger solution.

We will continue operating our NOC, Helpdesk, and traditional IT infrastructure services as long as it makes sense.

New Key Resources:

The key resources of the traditional model have not changed and only one is added. The IT management frameworks are now a huge value. The clients have locked in and we are driving the heart of their business. Looking at your company valuation, this will be the highest component in two to five years.

The key resources of the traditional model have not changed and only one is added. The IT management frameworks are now a huge value. The clients have locked in and we are driving the heart of their business. Looking at your company valuation, this will be the highest component in two to five years.

New Key Partnerships:

The goal is to get some commission based on the sales of those services. As a vCIO, you are making decisions on behalf of the client, which means you are going to face problems and look for solutions. Your marketplace is the set of solutions looking for problems. You are the interface between the two worlds, coupling problems with services.

If you think five years into the future, 75% of an average client's budget will come from cloud-based solutions. It’s not difficult to calculate how much money an MSP could make based only on recurring commissions. A general cloud-based provider (Salesforce, Google, or Microsoft) could offer 8-10% of the sales recurring. A smaller niche provider could leave 20-30% of the sales on your side. Revenue could be coming in every month with just these partnerships.

This is a cloud broker model. However, we are not brokering just traditional cloud service providers, but every software company, because everybody will be switching to a cloud-based delivery model in the near future.

New Cost Structure:

Nothing has changed. We are probably paying more to create marketing content, education, and to train ourselves and our staff.

Nothing has changed. We are probably paying more to create marketing content, education, and to train ourselves and our staff.

New Revenue Streams:

Plenty of new possibilities here. Revenue streams: the vCIO and IT management framework implementation projects have significant power. These projects create all the prerequisites for IT management including procedures, processes, strategies, plans, contracts, and agreements with vendors that have to be created to manage the environment.

Revenue streams: the vCIO and IT management framework implementation projects have significant power. These projects create all the prerequisites for IT management including procedures, processes, strategies, plans, contracts, and agreements with vendors that have to be created to manage the environment.

The sales process has to be adopted in the early stage of the market. Delivery must incorporate a new role. Processes and procedures must drive the new role, instead of doing it ad-hoc, to gain recurring predictable and scalable service revenues.

A new way of connecting problems to solutions comes from the nature of the vCIO role. Creating such a marketplace is a natural move to make the business more predictable and scalable .

Conclusion:

These are two big trends of technology - it’s becoming easier to use while management of all the choices is more complex and creating a tornado. If you think you are going to be able to stay only a 1.0 MSP, cloud and reduced complexity is going to put you out of business. If you are not getting into IT management, you are missing the boat.

The new model will enter into the mainstream in the next few years. As it does the incumbents will have tremendous advantage over new entrants. The learning curves, the thought leadership, and the processes are hard to copy or implement quickly. In my opinion, someone who invests now and spends the next few years developing this model would be reaping the profits in the following 5 to 10 years.

During the next session, we are going to talk about the specific MSP 2.0 related Projects, Ongoing Services, and the natural adoption of the model in 12-24 months, so stay tuned. Subscribe to the Blog alert on the top right to make sure you get the new articles.

The process of becoming the Trusted Advisor

By Denes Purnhauser on July 8 2014

For Managed Services Providers (MSPs) the ultimate goal is becoming the ‘trusted advisor’ on all things IT.

We’ve created a process which enables MSPs to earn this trusted advisory role as fast as possible. The key is to understand the client, and in turn help them understand their situation and their opportunities.

Looking into the 7C Methodology and processes can be a tad overwhelming at first, we know. It’s so effective because it’s comprehensive, so there is a learning curve. However in our continuous effort to make everything as simple as possible, we’ll start by emphasising a couple of core concepts.

One of the crucial elements is the client reframing process. From the client’s perspective it’s a discovery process, the goal of which is to make the necessary transformation to start working with the client at a new level. The key component of the process is the Reframing 7C canvas workshop, where we ask questions of the client’s business in order to help the client rethink basic assumptions about IT and its management. Normally such a fundamental shift is a tough, very high level process, but if you’re properly prepared to ask the right questions and challenge the client, it can be a very easy and straightforward process.

Client Discovery

So to be able to conduct the workshop - the central element - with confidence, we have to be as informed as possible regarding the client, as well as the nature of the company itself: the key players, industry etc. We need a streamlined data acquisition process to be able to immediately focus on what matters. With an established client this is much easier...it’s the new for whom you must prepare a bit more.

If you peruse the 7C Report, you’ll find it entails all this needed information about your client in IT function and their IT management perspective.

To be able to get the necessary data from the client and to be able to make the analysis and build the report, you need input. This input comes from the questionnaire you get your prospective client to fill out - not the client's ‘IT guy’, or service provider, but the CEO of the company -the one responsible for the IT in general at the senior level. We’ve provided several helpful methods encourage them to fill out this questionnaire. If it seems like a big deal for them you can infer either that they do not trust the value of the process, or that they see little value in IT generally. In either case you can make the transition with the workshop, so do your best to get started with the questionnaire.

This is the discovery of the client that prepares for the workshop.

Reframing Workshop

In the workshop you are going to use the 7C Canvas as a companion. It goes on your wall and comprises all the building blocks of the competitiveness of IT.

This is meaningfully accessible to the client: there is the IT execution segment, and the IT management - both cost-effectiveness and the competitive edge. It creates a conducive platform for talk about the company's challenges, issues and the possible IT related solutions.

First of all the Canvas will assist your confidence in the meeting, with the information on the wall 100% aligned with the report, scores, etc.

Secondly, it outlines the structure of the session, which in turn helps you to facilitate it.

Thirdly, it engages the clients in conversation - this is a workshop, and your goal is to work together and strengthen the relationship.

Fourthly, unlike some workshops, the Canvas remains, a good basis for further conversation between the CEO and the rest of the company.

The outcome of the meeting is some initial action items involving overall objectives, directions, and possible initiatives or projects.

Action Plan

Your next duty is to build a comprehensive action plan for them based on the results, and set a possible achievable target score, and to put everything in context, set priorities, state realistic expectations about IT project sizes, IT budgets, possible results, and the necessary capacity from the senior level or from staff.

So now you are becoming a natural leader of their Global IT, not just the infrastructure, background, support etc, and you can come up with big projects and industry changing initiatives with IT. This is the process of how to start your work, what you need to achieve the first quarterly plan.

As you start the first company-wide quarterly plan (the cornerstone and "trial" of the MSP 2.0 model), you are incurring more information, more trust, and even more loyalty.

Here’s where we kickstart the MSP 2.0 onboarding process to implement all necessary parts of the model - where you are able to start the complete IT management operation with the client.

Conclusion

Maybe you see this is a long process, but slow is fast and fast is slow in this arena...the initial investment of preparation will soon lead to a pivotal element, the inflection point which is the workshop. You get the client’s attention and from there are able to reframe them. Discovery and the preparation, workshop, action plan, and finally trial quarterly management - these five components give you the proven process of client reframing.

Why are clients lately needing more consultative work from MSPs?

By Denes Purnhauser on July 6 2014

So we all agree that IT companies are facing challenging times, right? We all need to figure out a new business model in the near future. But what about the clients? Are they facing a similar problem? We have to take a good look at what’s happening on the client side to understand the trend.

We’ll use a chart to make the explanation easier. We’re looking at how things have changed in the last couple years, and where it could go.

In this chart the horizontal axis is the business impact of IT. It shows how in time, the overall IT influence has changed on the client's side. How the IT impacts their everyday activities, but also product development, communications, service offerings, manufacturing and so on.

On the vertical axis you can see the overall complexity of the IT ecosystem, showing that over time it also has changed on the client's side: the number of different processes supported by an IT system, the amount of software and, hardware, connections, and network infrastructure in their ecosystem.

We graphically emphasize the overall IT management challenges with bubbles. The bigger the bubble gets the bigger the management challenge on IT.

So meet Carla, who runs a travel agency with 75 people and in a growth mode which she started in the mid-eighties. She’s quite IT savvy, and so has several legacy custom software applications still in use from way back then - word processors etc. IT wasn’t always a big deal, nor so complex, and had a very limited impact on her business.

In the nineties, they all upgraded to PCs, fax modems, better software, Windows - the big boom of the PC era. At first only the IT-savvy few were using that software, but as Carla upgraded to a more integrated ERP, the whole company started to. IT was getting more and more complex, with more software and hardware.

Even the reliability of a smooth running system was a big issue, but because everything was still backed up in hard copy, in the case of an outage the operation wasn’t catastrophically ground to a halt. When such management issues came up, someone internal who was familiar with the systems did the techy work.

Since 2000 the internet has become ubiquitous in business, so they upgraded again to a better ERP with CRM, and more communication to clients, and invested heavily in infrastructure with servers.

Because collaboration and email was a daily use they had to keep up with new tools as well as products being constantly developed. Every three years they’ve had to change the whole infrastructure with PC-s servers and softwares.

The local IT person was no longer able to manage so they switched to a IT Managed Services Provider, who was able to support all their systems from a technical standpoint, including helping them figure out upgrades, projects, and developments related to the IT infrastructure.

That was the “BC” era... Before the Cloud. In 2010 the cloud became the new standard, and we’re now ‘AC”...After the Cloud.

Carla has several internet based applications running. Now she can acquire and usually run nearly every IT function from the net.

Still she does not want to put everything in the cloud; just the most basic things, both to be more efficient and to incur less expense as a service. She enjoys the continuous development of the services without having to involve herself in big projects, upgrades, or infrastructure investments.

Small companies next emerged in the beneficial new milieu of AC, and had very cheap products available immediately without any server, or PC work. So they decreased their budgets supporting the old-fashioned infrastructure. They switched to Office 365, relying heavily on Google Apps with clients, using mobile devices with dropboxes, etc...hundreds of applications tied to devices without any coherent structure or defined boundary.

So Carla missed the direct but responsibility-laden control of the infrastructure in a way, but is prepared to move on. All she really needs is someone who can give her the control back, but the myriad vendors, ERP, CRM, B2B, B2C, cloud applications, integration software developers, and web developers are overwhelming her.

The MSP is doing his job, but there’s a role going unfilled: someone who puts all this together. The business impact is enormous now; if a system goes out, the company can be entirely missing a part of the operation.

The complexity of the ecosystem is now very high, and aching for adequate control.

This new role needs to be a very high level non-technology oriented management duty. Currently only the structure of the IT is managed. Unfortunately her MSP is focusing on too much on the technology side, which is not an issue. She is missing the management part - the Global IT budget, the management of vendors, the direction of projects, security in global, real IT strategy and so on. The MSP is performing their job at a high level, but aren’t able to give a comprehensive solution for her IT altogether.

So we see the challenge of Carla is to get something that seems beyond the scope of her current Managed Services Provider. She could go the path of developing an internal staff, and solve the problem sooner or later, but it would be far more competitive if the IT company could transition to the MSP 2.0 business model, which is basically management of IT with a global approach to give a competitive edge. Carla is willing to pay the additional fees to the MSP, as they have an established relationship, and she trusts she’ll get the functionality and performance she needs.

Carla needs a new working model from the MSP.

The MSP Stories that lead Managed Services Platform projects

By Denes Purnhauser on June 23 2014

Some of you have been asking us about our background, who we are, and why we’re doing Managed Services Platform.

Our Challenge

One of our companies at first was an IT managed services provider. We’ve since reintegrated it into our holding company, but think telling its history will be illuminating...

We discovered that while our clients always needed consultancy on IT in general, we lacked a viable model to do it both properly and profitably. We’ve tried to incorporate the consultancy into the MSP high-end package, and tried to do T&M. Neither approach was satisfactory.

But the pressure just gets heavier as we’ve been witnessing the evaporating services on our MSP practice, accompanied by ever increasing needs of the clients for IT management, vCIO, and 3rd-party-project management, all while IT gets more complex in terms of organization management.

7C IT Management Framework

We’ve created a checklist questionnaire, the aim of which was to improves sales of our services while setting the stage for prospects. We tried to ask the questions we knew they were trying to formulate to express their needs. We gave this questionnaire an easy to follow structure and designed it to produce a score for each taker. We’ve identified seven critical aspects of IT competitiveness today, and because we were able to pick seven words starting with the letter “C”, we called it "7C.

We gave this questionnaire an easy to follow structure and designed it to produce a score for each taker. We’ve identified seven critical aspects of IT competitiveness today, and because we were able to pick seven words starting with the letter “C”, we called it "7C.

Once we started to send this out to prospects and clients it became a dynamic tool. The software behind the analytics that produced the score and report was popular too. Also, because it was about business terms, it helped somewhat demystify IT. It covers all the aspects of the activity of IT management that 40-200 seats company need to know about.

Reframing Your Clients

One of our ventures at this time was with our other company - where we became a Country Developer for a General Management Consultancy methodology. This was a general company development framework with strategy building, organization, execution, and alignment. Uncommonly at the time was that it was a true 100% consultancy business, though it had a monthly recurring service model, a project for implementing the framework, and recurring service revenue to maintain it.

We got curious; if general consultancy was able to work out with a recurring service model, it must work with IT management, as well.

We then started to implement the principles of the general management methodology to IT. We listed all the duties of a vCIO, from client discovery to strategy creation, quarterly planning, documentation, audits, vendor management, execution, communication, leading the internal users, IT admins, and so on.

We end up with a framework like ITIL for small clients, with implementation, project-oriented and ongoing activities. We put all this into various packages and started to offer it SEPARATELY from our MSP contract.

The kicker was that we had charged a lot for the implementation of the IT management framework.

Our value proposition was that we were able to get you from 28 to 75 in 6 months with the implementation of the framework. CEOs were able to grasp this measurement thing quite adeptly.

That was the tipping point. We have more than doubled our size in nine months. We’ve added several new clients, and several new doors are opened with the productized SEPARATED vCIO roles.

We even acquired a client who had MSP but with weak vCIO role, and have done more than a dozen “implementations." The sale itself, not to brag, went rather easily, because the result was very tangible to the clients. Everything from strategy to roles, activities and documentation, etc. is dealt with by the software. When they saw the vision and the results, they ordered the project. Then to maintain every part of their IT ecosystem they ordered the Virtual CIO services.

Everything about us follows from this story. We wanted to share our questionnaire, the scoring, the model, the pricing, and the packaging to the MSP community. Because we are running so many things at once (we are starting a pure MSP 2.0 company in Canada with no MSP resources), this venture has long held a status of our pet project.

Along the way Autotask and GFI saw an opportunity in what we’re trying to do. Both of them supported us in a big way to be able to move forward. Those guys are just awesome!!!

We’ve now pulled off a website and have a handful of companies using our beta, but are still fine-tuning the package to be able to help other IT companies the best we can

MSP 1.0 vs. MSP 2.0 [video]

By Denes Purnhauser on June 20 2014

MSP 1.0 is not widespread yet as a business model, and there is already the new 2.0 model.

What are the key differentiators between the two models? The following will refer to an average MSP 1.0 and MSP 2.0 practice.

We are assuming that the MSP 2.0 model is heavily supported by an MSP 2.0 framework, which is crucial. The differentiations may seem simplistic, but our aim is to show the possible limitations and challenges of the MSP 1.0 model, and the opportunities of the MSP 2.0.

Keep in mind that MSP 2.0 is not a substitution of the MSP 1.0 model. It is an expansion. You can move your existing 1.0 services forward, but with 2.0 as a companion the new options are going to be very promising.

Tech Value vs. Business Value

Giving someone a technology solution is not necessarily giving business value. The technology solution is only a part of the complete solution. If it is an ERP, the software is just part of the internal processes, interactions etc. If it is an email system, it’s also integral to the entirety of company communications.

The business value of an ERP project to is to enhance the efficiency of their processes, through automation and streamlining. The business value of the email system is an effective, well-processed, internal and outside communication system with secure limited access.

The technology is 30%; the rest is HR, management, controlling, etc. With MSP 1.0 usually the MSP does only the technology part of the project. In MSP 2.0, they become the leader of these projects; evaluating vendors, conducting the project management and quality control, as well as implementing the technology. This is a very visible difference in value to the customer.

Techy Slot vs. Trusted Advisor

The general limitation of the MSP 1.0 is that you are a technology service provider, and you provide value by providing technology. Yes, we know, this includes you providing business sense for the different solutions, but you don’t usually receive the following call: "Hi, we need to expand our operation abroad, and we need your expertise." or "We want to penetrate the new market segment and establish a sales representative system. Let’s figure it out together."

More likely it’s in the form of “‘You guys know any accounting packages which can handle foreign currencies?', or "Can you guys deploy a server for MS Dynamics CRM to us?" You’re pegged into the "Techy slot."

That’s a noble role to fill if you want it, but you will find yourself waiting for them to realize they need something concerning technology - it limits your opportunities tremendously.

Instead with MSP 2.0 you give them business value, which means you are there if they have a major challenge, development, or other change in their business. You stay current with their vision and direction so you are able to become a Trusted Advisor, or virtual Chief Information Officer (a vCIO). You’re already there well before the issue with technology arises, and you’re able to alert them to an IT challenge and background support for their decisions. This vastly expands your billable opportunities.

Thin Focus vs. Broad Focus

In MSP 1.0 you focus on technology, and your part of the client side. Maybe you give them quarterly planning sessions, even some kind of strategy, but the scope of these projects is limited to your service scope. In MSP 2.0 you think of the entire operation holistically from the client's perspective.

You re-think your MSP 1.0 service as one piece of the pie, and now manage all the vendors, third parties, and even the internal IT team to some extent. You negotiate the support contract for the ERP vendor, sign the bill of the telco company and so on. Your focus is on the global value creation of the IT, not just the MSP 1.0 scope.

Low Level vs. High Level

Alistair Forbes, General Manager of GFIMAX is presenting the Concept publicly first

With this in mind you can see that the MSP 1.0 focuses on technology and low level execution. MSP 2.0 focuses more on high level management. Don’t think of one as better than the other, but rather as models with different scope and approach.

Most of the time, the low level ground work isn’t visible to the C level executives. They are not able to measure and evaluate costs. In high level work, you are dealing with them personally and you help them with their problems. Your visibility is entirely more significant.

High vs. Low Acquisition Cost

With MSP 1.0 you’re often being summoned by a client with some painful problem. If they do not have IT related issues, it can be difficult to convince them to move forward. Also since other problems will keep arising at unpredictable and distinct times, you can’t stay connected with the prospect and ready when they have the next painful issue. It’s necessary to keep the relationship going for a long time in order to be visible and trusted to let them know of impending problems to which you have solutions.

The process of starting a business can be quite slow and unpredictable. On the other hand, MSP 2.0 gives a solution to a general problem, and is not dependant on big problems and imminent pains. You are able to start the conversation any time. Reframing this approach will lead to closing more deals. MSP 2.0 means you can start a basic service and as problems and opportunities arise you can upsell your higher value MSP 2.0 services.

Hard to Acquire vs. Unique Value Proposition

The other sales-related problem in MSP 1.0 is not just the closure ratio and the long cycle, but the effort needed. Usually the entry barrier is very high. If there is another MSP vendor, even a poor performer, you have to be able to prove your service is better at the same price, and usually you have to bear some part of the switchover costs. This means a fight over minimal margins.

In MSP 2.0 your service is of a higher level with a very Unique Value Proposition. It does not really matter what the existing situation is on the low level. You can offer your services in a white space, without internal competition. This makes the process easier, without sacrificing the profits, and without high switching costs. Of course still if you are competing with any MSP they will be seen as redundant quickly.

Pushy Sales vs. Consultative Sales

MSP 1.0 is a quite competitive place to be, so sales tactics can be pushy with practiced sales techniques, closing strategies, and unnatural communication. It reduces the comfort of the prospect and erodes trust, because you need to talk them into something.

Immediate solutions to real problems are still in play, but this occurs less and less as the market saturates.

In MSP 2.0 with 7C, the sales technique is different: a consultative sales approach. You get to know them in a business and IT perspective, in casual meetings with questions, helping you and them both understand their situation with a questionnaire-based benchmark and report, conduct a workshop, and create an action plan.

The more consultative experience shows your value from the get-go. It’s also more natural, as you can demonstrate your valuable expertise in a formatted way and garner trust during the sales process.

No MSP Sales Process vs. Predictable MSP Sales Funnel

Usually smaller IT managed services providers don’t have any sales oriented people, so the sales process is absent and the acquisition and the upsell unpredictable. Even more mature mid-size IT companies lack a streamlined, well-controlled, transparent sales funnel with all the metrics and motivation for the salesforce.

MSP 2.0 with 7C IT management framework is both the sales funnel and the consultative sales process. If you have a clear message for the audience, the inbound marketing is easier. You have an inbound marketing tool, a discovery tool, questionnaire, analysis, report, workshop, action plan builder and first quarterly plan.

This sales process will identify the necessary relationships, rationally spread the responsibility and clarify accountability. Also, because the process is well-defined, you are able to easily educate the client for more predictable results.

You can quickly implement the funnel as an inbound marketing campaign, and expect new clients in 4-6 weeks. Even an inside salesperson can acquire good quality, targeted prospects in 2-3 reframing workshops, which, with a 50% closure ratio is 4-6 new clients every month.

Low CEO Awareness vs. High CEO Awareness

As we have seen before, general awareness of the MSP 1.0 services is quite low. Usually during the reframing workshop with existing clients, it turns out that they don’t know what you do on a weekly or monthly basis with their back-ups, policies, and so on.

You may have discussed it with them and they may have nodded to do it, but these don’t stay front of mind, especially if you are working so well that you avoid outages or firefights, and completely disappear. In MSP 2.0 with 7C, you are working with the CEO directly.

You solve their business-related problems, gather information for them to help guide their decisions, lead their virtual IT department with all the vendors and internal IT staff, and report to the CEO directly. This greatly enhances your visibility and awareness of the CEO as to what it is you do and how much value you actually deliver. It’s a different relationship, trust, and respect level.

Slow Progress vs. Immediate Results

Although managed services providers usually have a wide portfolio of services, the client often signs up for a limited part of it, and it’s a very slow process to upsell all the great new services. Why? MSPs are not really proactive, and the whole portfolio is rarely known as part of the client’s business lexicon.

The client sees separate services instead of the big picture you can bring. With the 7C MSP 2.0 this is different. It’s much easier for the client to draw a development roadmap for 1-2 years, and execute the development plan with the MSP, because you put your and other IT services into their business context.

You are able to gradually raise the maturity of the client in a measurable, accountable journey. This gives you a faster, more aligned process to grow on the client side. Everything starts with a very solid 1st quarterly plan. Executing it flawlessly will open the door to further development projects.

Commodity vs. Margin

Alistair Forbes, General Manager of GFIMAX is presenting the Concept publicly

Because the MSP 1.0 market is now so saturated, the competition is tight, vendors deal directly with clients, and services are in very tough markets. This is called a communization, where, at the end, services are differentiated only by price.

To avoid the communization and avoid lower margins and price reductions, you have to change or extend your model. MSP 2.0 with 7C provides the client unique benefit and business context, and a very powerful weapon against their competition, leaving you in a very unique position.

This way, you are able to sell your existing offers at a higher price, while also more streamlined, and very profitable. Also, because the MSP 2.0 model is very new and rare, it’s seen as a high value service worth a higher price.

Avarage Brand vs. Remarkable Brand

As a local technology company, it can be very hard to be seen as a remarkable brand. With all the communication, service delivery, and collaterals, 100% alignment is needed to give a consistent brand feeling. You have to have a very unique value proposition where everybody knows what’s behind it. Volvo is a safe car, Starbucks is a great place to relax, Apple is a great user experience.

MSP 1.0, doesn’t include these engaging messages. MSP 2.0 with 7C, it’s different. You can show a very stable user experience during the sales process, your messages, the service delivery, and communications. It is fundamentally more professionalism and inclusive while maintaining a friendly, down-to-earth feeling. Your brand will emerge and become remarkable locally with high referral rates and powerful communication.

Cloud risk vs. Could proof

The Cloud is disrupting the MSP 1.0’s main business and revenue stream, its infrastructure projects and support. All related services are changing, as well as the consumption rates. This is hurting MSPs. In MSP 2.0 with 7C, the cloud model is actually favourable. You can use the growing complexity and business impact of the several different cloud-based applications and services to sell to the management layer on the client side.

Mixing Cloud applications with on-site integrations and reliability concerns means security is a big issue. You can control the whole ecosystem and build a solid service, managing IT at a high level and ensure departments, technologies, approaches, and models of delivering IT are completely in harmony regardless of the client’s particular business model.

3 ways to segment the market for MSP 2.0 services for maximum effect

By Denes Purnhauser on June 17 2014

Many MSPs are not able to well define their target segments. The result can be a huge sales effort with disappointing sales closes. There are three main differentiating factors we could use to fine tune service directed toward the different segments:

- Industry, verticality

- Seats

- Complexity

IT managed services providers could divide their market among three segments described below to benefit from more focused communication and delivery strategies.

The 3 minute video discusses the segmentation based on seats and complexity.

So you are convinced that the MSP 2.0 model with the 7C is a good companion for you. Maybe you are just interested in who can benefit from such services; who are the target markets? So here’s a nice chart again. We are going to see how we can divide the market into meaningful segments to be able to communicate better and give the needed service.

In this chart the horizontal axis shows the business model complexity, with respect to the operation and the business processes of the client. You know clients whose processes are fairly straightforward and easy to maintain, but you also know clients who are developing the internal operation building systems all the time. So we measure these activities on the scale of the horizontal axis.

On the vertical axis there is basically the size of the company with relation the IT ecosystem. So if there is a manufacturing plant with 40 office workers and 150 floor workers, we count them as 40. If there is a service company with 20 employees with individual subcontractors of 20, all of them connected in any way, we count it as 40 as well. We want to see the people involved in the IT ecosystem.

Let's divide this chart into 3 segments.

The first segment is the MSP 2.0 light segment

Here we have the companies with fairly low need for IT management and MSP 2.0 services.

Either they have 30-40 people, but very limited complexity, or very few people with a complex operation, but they can handle it mostly themselves.

We can offer them an MSP 2.0 light version, which includes only the yearly cycles with IT strategy facilitation, budget settings, alignment, and the quarterly sessions with action plans etc.

We are just trusted advisors here, giving them the structure, and the facilitation. The rest they can do, of course with our management support from the background.

The second segment contains the companies with more people and more complexity

The upper limit is where they have to have an internal CIO full time with an internal IT team. This is flexible depending on the industry and the management style.

So in this middle segment, we can run our weekly and monthly IT management rhythms. In this section we are involved more in the execution part of the operation and are leading the departments and so on.

This is the ideal way to deliver the MSP 2.0 as we have full control and we can give the best value per dollar.

In the third segment are the companies with internal CIO, part time CIO, and internal IT

Here our value is in providing the necessary framework for them for an efficient operation. Basically we can onboard them to the MSP 2.0 activities, coach, support them and give additional management capacity, outside control and advice.

This is a very fruitful segment, because we are able to get a very limited accountability in general, but we can get a project to manage or execute completely. So this is a good way to have a strong link with a company who usually runs several high value projects all the time.

So the lines are not strict but more like guidelines. You have to put your clients in one of these slots, and try to establish the model as best suits their needs. In the first segment you have limited resources but high profitability, in the second the monthly recurring is highest and you can get decent project work and additional management work as well. In the third you are the trusted advisor and help them establish their efficient IT operation, and you can get the juicy projects to manage or execute.

How to decide whom to transfer from Time and Material to MSP contract?

By Denes Purnhauser on June 7 2014

Identifying these companies is always a struggle, so here are a couple of tips to properly selling the MSP services.

I. Identify the segments we want to exclude

Identify which company size, culture, and verticals we have to exclude from communicating the values of MSP, freeing up our sales and marketing resources.

Size:

Usually under 15 users, the problems are not that visible, and the price is quite high to be able to sell the managed services. Try to sell cloud-based solutions to them and manage those like Office 365.

Culture:

If the company’s or the CEO's culture is to invent everything inside, they’ll want to do most of the jobs and minimize paying for extra skills. The T&M is ideal for them. You have to keep in mind that you are always educating your clients on definitions you want to sell MSP. For example, you may tell them good things about RMM and ProActive, then when they sign up for LogMeIn and think they are going to have the ProActive stuff.

Also, keep in mind that CEOs are often unable to take the long view about the value of the MSP. The problem here is that they are not going to understand the boundaries of your services. Therefore, they will think everything is included (which is not the case), so it’s a struggle to bill for the projects and additional services they are consuming. It will hurt your profitability because either you are working for free or you and your account managers are regularly dealing with misalignments and speed-bumps.

Verticals:

Very old-school types of verticals do not really go for MSP. They do not think of IT at all, and this is a cost for them. They do not even rely on IT - If it fails, it fails, who cares. So for them, the value is very limited.

Do not try to upgrade them. Either keep them and allocate lower-level people there and do not focus resources, or terminate some of the contracts and pass them to your competitor for a referral fee. Cleaning your portfolio can be very helpful, and most of these clients are going to change dramatically.

II. Identify the Time and Material contract that has potential and sell it

Identify the segment of the T&M contracts that have the potential, size, and culture but do not yet buy those services.

The main point to get across is that they could implement the MSP services into their business benefits. Usually we speak in “educated guesses” about these benefits. Proactive maintenance means more uptime; servers are always updated and secure. Our guess is that the terms "uptime," "update," and "secure" have specific business value to them, so they will see the overall benefit. In case they do, they already have an MSP service contract.

There are some who won’t see it. IT has nothing to do with their bailiwick. They’ve been successful without it so far and do not understand the connection between their benefits and your services. The connection so far is likely vague (general), theoretical (not practical), event-based (ex. disaster), and artificial (not real); so they do not buy.

Discovering the specifics these businesses care about and connecting them to a solution is a very difficult and time-consuming process. They may not participate in a first meeting if they don’t believe they have a problem you can solve. Therefore, you do not have even a chance to make it happen.

How we should hack the system?

1. Platform:

1. Platform:

You must find a common ground or a common platform, and then you will be able to talk about the problem. The platform should be independent, business oriented, fast, reliable, and proven.

That means the common ground (as a IT benchmark, score, and measurement) is going to be this topic of discussion rather than your services.

2. Performance Measurement:

You have to face them with the truth in a measurable way...give them back a score and show them how much more competitive they are with IT, or show them the competitive disadvantage they now have.

This measurement process must be easy and fast. As a result, they are going to receive a score that represents their performance. Because they are currently in the Time and Material group they will score low. This means you can compare this with the standard for performance you set together, and then they will see the opportunity to improve their performance.

3. Social Proof of the Norm:

You must have social proof that the average companies are doing better on that scale. Consequently, you have to define a standard and set the standard as an official, independent norm. You have to show them benchmarks in their industry as well. Show where they are lagging against their competition overall. The norm is defined by the platform, the common ground.

4. Show the score of the MSP services:

They will see that there is a measurement and that their score is low. The small details are less important - the overall picture is low. You can then present the MSP contract, which will present a notably higher score. In ITCq, you can set your service offerings to the scores, so based on your service offering, a target score will come up, showing the exact score they could have using the different types of your services. They’ll see how they can outperform the others, and you can highlight how much and why.

5. Show them the financial benefits.

Now that the understanding of the value is there, you only still have to present the price, which should be high, but in comparison to the value, a good investment. You could set targets for 90 days and for a year, which you can guarantee. If the scores do not exceed those, you give their money back. Because everything is in your control, the scores depend on what you are doing; it is not at all a risk.

Conclusion

The way to switch to the MSP 2.0 contract faster is to divide the segments of the potential buyers and non-buyers and then use a measurable platform to create the sales for the clients who have potential.

Why are MSPs struggling with IT sales these days?

By Denes Purnhauser on May 29 2014

We think that one of the biggest reasons for this is the failure to separate different kinds of sales, and trying to use one strategy to sell everything offered.

In the days before cloud-based applications and storage, when clients had to maintain a lot more of their own IT infrastructure, when the inevitable problems arose there was a clear need for the MSP to be there - to use a bit of business-validated tech mumbo-jumbo, and the sales were natural. Because the client had obvious identifiable business pains, the choice of solution was straightforward.

These formerly ready solutions are now fragmented; company infrastructures are much less homogenous, so our model of one-size-fits-all IT service is no longer appropriate. In short, sales have become more complex.

So let's simplify the different IT sales roles and address them.

1. Upgrade T&M clients to MSP

Problem:

We have so much potential on existing T&M clients, but they have not upgraded to the MSP recurring contract yet - we’re leaving money on the table.

Challenge:

In order to import these existing clients we must demonstrate the business value of the MSP contract versus the T&M contract, but C level executives are rarely aware of the subtleties of this distinction and usually don’t put them high on their list of concerns.

Solution:

First of all, you have to identify who could benefit from the MSP contract at all. Companies of 15 or fewer users rarely suffer the complex problems an MSP contract solves. Give them the service of T&M, but don’t wait around hoping to see great potentials arising around them.

Second, you have to produce a business comparison between the T&M and the MSP contract in terms of delivered value, rather than on the features. To that end we developed the Managed Services Platform scoring system, which illustrates the difference in the competitiveness of IT with T&M compared to that with an MSP. This practical measure commonly generates T&M scores of 10-20 out of 100, and 45-55 for operations with managed service provider. This is their introduction to what we call the reframing process.

2. Acquire new clients

Problem:

There’s no getting around it...it’s real work to go through this process effectively.

Challenge:

This is a long process; you have to create leads, qualify them, and invest a lot of time with no guaranteed results. Long hours and multiple meetings go by without us and the client reaching alignment. We know there’s opportunities, but those who would benefit often seem unable to see them.

Solution:

After the first initial meeting, we usually use the IT competitiveness scoring we used in T&M. The role here though is different; it is is to evaluate the business context of their current IT setup. The scores show what they have going on at present. Our role is to assess what score they want to reach.

So if they score a 30, why is that? Do they lack the wherewithal to score higher, or is it a matter of choice? We can then use the different topics within the composite score to introduce possibilities. This shows them a clearly structured way to assess how they can enhance their IT’s impact on being a competitive company. Also, the benchmark score gives them a reference point for them to compare their performance to the industry.

Finally, with this approach, client acquisition could consume less of the upper level personnel's time as the process is standardized and proven in use.

3. UPsell third party productized services

Problem:

For some problems, we are tasked to find the solutions.

Challenge:

There are so many XaaS offering MSPs that could sell (virtualized desktops, BDR, DRP, etc.). Most of them are disrupting one or another current MSP service, so it is quite difficult to fit the portfolio. For example, Office 365 is now disrupting current Hosted Exchange solutions, and BDR solutions are disrupting our existing backup practices, and so on.

Solution:

This is product-based selling, which is very different from traditional service-based selling. Although the product is a service, there is a beginning; an end; and a package with features. These are not the flexible services we usually sell to customers.

That means that there are are certain problems and opportunities that can be dealt with by features you could put on the contract page. For instance, you could have a slide deck, and the problem is solved therein.

However, you have to determine if clients are interested in the features and then sell them, and because we’re talking about product selling, a different IT sales approach is required. Hire IT sales representatives for that and let them do the job...give them the quotas and products, and train them. Then you can sell those items since you’ve defined the problems have been through a minor discovery, and consulting will follow.

4. Complex Solution Selling

Problem:

Complex solutions like MSP services are hard and slow to sell, but are where the big money is. These are the complete cloud adoption and virtualization projects, ERP, CRM, and B2B E-commerce solutions we are always waiting for.

Challenge:

Selling complex solutions is a slow process. It involves third parties, and figuring out the needs of the client and evaluate the available solutions. In this case, it is very unlikely that we are operating without any competitors, and while our services are not always measured, our products are. So even when we’re great, they have their own priorities, and could choose another product.

Solution:

In most cases the party with the better understanding of the client is going to win, so again we highly recommend the IT competitiveness scoring tool, as it will distinguish us from our competitors. We can be more sure and precise about their priorities, problems and hidden opportunities. In this way we‘re able to develop a more appropriate and tailored solution, and highlight this in our presentation. Moreover, showing the business context around the IT solutions is always beneficial. It means we spell out the "why" of the solution, instead of the "what" and "how." The client will understand from their own point of view why they need those in their operation, sales, marketing, etc.

Conclusion

First, understand what you’re selling. Don’t use one method for all different types of sales, sell only one thing at a time, and don’t sell everything at once to a new client - you’ll likely mess up the flow of processes, and leave the client confused.

Second, use a business scoring tool to align your prospects and clients with their business perspectives. It’ll helps you close deals faster and with a better success rate.

The Hard Truth: network assessments can end up as an MSP's worst enemy

By Denes Purnhauser on May 15 2014

Most IT managed services providers are heavily dependent on some form of network assessment practice during their MSP sales process. They gather information on all the prospect’s devices, identify problems and performance-related issues, and then present a comprehensive report, with an action plan that aims to fix those problems.

Although this practice can surely help win over new clients, it also can be the single most important obstacle they face down the road, in terms of further work with them.

The mistake is that the network assessment puts the MSP into the "techy slot". This is a matter of the client's perspective; executives put potential vendors into this slot to make their busy livese easier and simplify their world. There are slots in the executives' minds for many things: roles as consultant, service provider, software company or industry, HR, IT, or accounting.

There are also varying levels of importance to them: high (business-related), medium (operations), low (support), and of accessibility, such as the scarce/premium, easy to access, and commodities. So for IT providers to excel now in the industry, they should seek a business-related consultant slot where there are high levels of scarcity, rather than staying in the IT slot, as a service provider, low-level support or commodity slot.

The untold story is that these first impressions are very difficult to change later on. Once the deal is made with us pegged in the tech slot, it becomes a self-fulfilling prophecy; instead of being judged on our experience and skills, we are sold short by common perception. If they see that our company is professional only on low-tech ground work, then they’ll subscribe to only low-level tech services, and we’ll of course perform those eminently well, securing their perception. A negative outcome of a positive feedback loop - closed. Done. Locked for eternity.

That’s why a different first impression is crucial. (There’s no second chance at a first impression.) If providers cannot manage this first impression, they could be dropped into a slot from which there is no way out. It is the slot we could call "the deadly tech slot." This isn’t what the network assessment is supposed to do - relegating us to the lowest possible category in the mind of our potential clients and a role as a low-tech solution provider.

Ok, I admit I’ve never actually heard any IT service provider complaining that they’re in the tech slot. They proudly purport that they’re in the business / trusted advisor slot. However we all know the difference between how one is seen and how one thinks one is seen. The fact is that there is a high chance that the client's perception is completely different than your company thinks.

Obviously, no one wants to be in the "tech slot" nowadays. It limits potential growth opportunities, control of the client, influence on decisions, profitability, and so on. Everybody wants to be a high-level outsourced IT executive and IT department for their clients. So then why and how it is happening anyway during the network assessment process?

1. Having the wrong conversation

First of all, the network assessment is driving the wrong conversation. It centers around technology-based, device-based, and tech-based ideas...about the flaws and risks and reactionary firefighting solutions.

This is a hot topic for the provider, but C-level decision makers usually don’t much care. They want a conversation about how to go from good to great, but instead are dragged into one about how to go from lame to mediocre.

The cause? The network assessment leads only to the service provider's concerns instead of the client's. There is no business-relevant context; only the "IT benchmarks" of mostly irrelevant artificial metrics that skirt around what the focus should be.

2. Causing the Wrong Client Feeling

Detailing to the clients how badly they’re performing puts them in a defensive position and thus puts the solution provider into an offensive light. The report can show that the clients have little control over their poor decisions, unwise expenditures, and weak ideas in the field, so they can easily feel backed into a corner.

They may even think it irrelevant - they already know they could be doing better, why do they need to sit through this - so they may not carry the conversation any further. Or when they do go through with the "investment" it’s because they’re frightened out of their comfort zones regarding potential risks, etc.

Thus, the decision is not motivated by will and vision, but by pressure, which easily fades away after the tension eases. These emotions are not ideal on which to build a relationship. Moreover, such feelings can misguide the provider about a sudden quick win-- they can sense huge opportunities that actually do not exist.

3. Creating the Wrong Environment:

The wrong environment does not help to carry business conversations and enable positive insights about the company. It does not focus on hope, enthusiasm, optimism, or growth—the typical entrepreneurial values. The environment our clients should be given is one where they can brainstorm... about the company, future projects, improvements, etc.

If we’re not encouraging a creative, "think big" environment, there will be no major projects, improvements, or developments. Only cost will matter; they will invest as little as possible because they don’t see the real value in what we can offer. They focus on problems, (most of them artificial) and how to fix them, rather than on how to invest in the future and create a compelling vision together.

How to fix this process - to change the game by creating the business context first.

Put the network assessment aside for a while, until we have created our image as business partners. It will remain a crucial element of the process, but not define the process itself. We must create the business context around the IT, and then the IT context around all the IT-related activities that the network assessment can measure.

1. Building the business context:

We need to act as IT consultants, using techniques consultants use to acquire clients. We have to be curious about the non-IT-related fields, such as how they grow, their customer challenges, and how their industry is changing. Not in a small-talk way, but with comprehensive, tough, thought-provoking conversations.

This will push us out of our comfort zone a bit, but relax! As a fellow business owner, you have more in common than you might think. Asking questions, actively listening, and not giving any advice up front are all key.

Peel the onion; dig deeper into the why. In this way we’ll create trust and understanding. Believe me, very few companies are doing that, so the client will be delighted to talk with you. You’re going to be a very rare breed; a scarce resource to find.

2. Building the IT execution context:

Once we understand their business context, only then can we drive the conversation toward the technology field: the leadership of IT, the people inside, the users, the company culture...by actually seeing their devices, watching how they use them, discovering their personal goals, etc.

Here, the critical element is to find out why they may have IT challenges, how they are operating, who is responsible for the field, and what other duties or priorities they may have. What is the level of their operation maturity? We have to understand the management issues or problems that can cause mediocre IT performance. We have to assure them that we have a complete view of what they’re facing.

We see the root of the poor decisions they might have made, as well as the problems they face right now, so we’re starting from the very top, from the very core of the business, and most importantly, we’re considering the individual motivations. After clarifying their IT context, we can then do the network assessment to get a clear picture about the specific problems and situation.

The result of the process:

After gathering all the business context discovery experience, and having all the IT execution discovery experience, we’re going to see the results of the network assessment completely differently, and we won’t concentrate on problems and challenges or create fear and bad feelings in the clients.

Instead, we’re going to focus on the big picture and the potential opportunities to make their company more productive: the benefits of our initiatives and a positive picture which will be much more likely to engage them. We can and must use our existing discovery tools, but only after we’ve created the context of our presence. This is what we call the reframing sales process, where we can change the game.

The 3 building blocks of a remarkable MSP sales process

By Denes Purnhauser on May 13 2014

I’ve been talking with a fellow MSP entrepreneur recently about sales. He’s been suffering the inability to find the right someone for MSP contract sales, so he or the other directors are saddled with the sales work.

This is actually the usual situation among IT managed services providers... I see it all the time. The directors, CEOs and company presidents, are doing the sales for MSP services and neglecting their bailiwicks...developing the business.